wyoming income tax rate

Wyomings property tax rate is 115 for industrial property and 95 for commercial residential and all. 4 percent state sales tax one of the lowest in the United States.

Wyoming Taxes Wy State Income Tax Calculator Community Tax

The state rate is 40 the average local rate is 134 total average rate for Wyoming Sales Tax is 534.

. The state income tax rate in Wyoming is 0 while federal income tax rates range from 10 to 37 depending on your income. Address Lookup for Jurisdictions and Sales Tax Rate. City Departments 62A District Court Pay A Ticket Court Records Search Making Payments Civil Division Traffic Criminal Division.

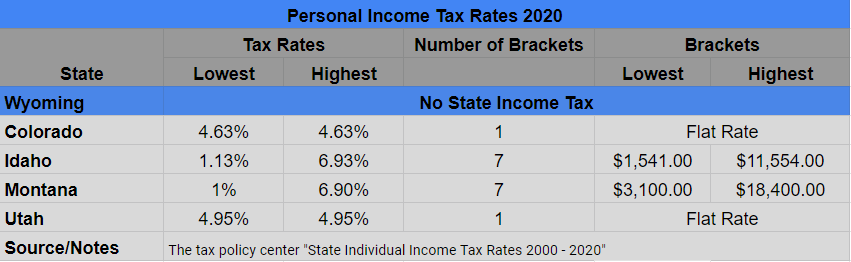

Find out more on Wyomings income sales and property taxes. Wyoming income tax rate and tax brackets shown in the table below. Use this tool to compare the state income taxes in Colorado and Wyoming or any other pair of states.

In Wyoming the median property tax rate is 605 per. This income tax calculator can help estimate your average. Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states.

The state gas excise tax in Wyoming is 23 cents per gallon. Wyomings license fee amounts to 0002 for every dollar of in-state assets the business has or 60 whichever is greater. Wyoming Gas Tax.

Wyoming does not have an individual income tax. No entity tax for corporations. If you make 70000 a year living in the region of Wyoming USA you will be taxed 8387.

If the total value of the businesss in-state assets is under 250000. Property Tax The. Corporate rates which most often are flat regardless of the amount of income.

Whether you chose to live in Wyoming or ended up there by chance you live in a state with a minimal tax burden which is excellent news for your. The state and average local sales tax rate is 539. State tax rates and rules for income sales property fuel cigarette and other taxes that impact Wyoming residents.

Wyoming ranks in 10th position in the USA for taking the lowest property tax. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. Wyoming Income Tax Calculator 2021.

Your average tax rate is 1198 and your marginal tax. Please note new mailing address as we update. Wyoming also does not have a corporate income tax.

Wyoming state income tax rate for 2022 is 0 because Wyoming does not collect a personal income tax. Any sales tax that is collected belongs to the state and does. The average property tax rate is only 057 making Wyoming the lowest property tax taker.

Some of the advantages to Wyomings tax laws include. Wyoming has no estate or inheritance tax. This is very low for a combined rate.

This tool compares the tax brackets for single individuals in each state. The average effective property tax rate in Wyoming is just 057. No personal income taxes.

The tax on diesel fuel is also 23 cents per gallon. Thats the 32nd-lowest tax in the country. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Wyoming.

States With The Highest Lowest Tax Rates

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

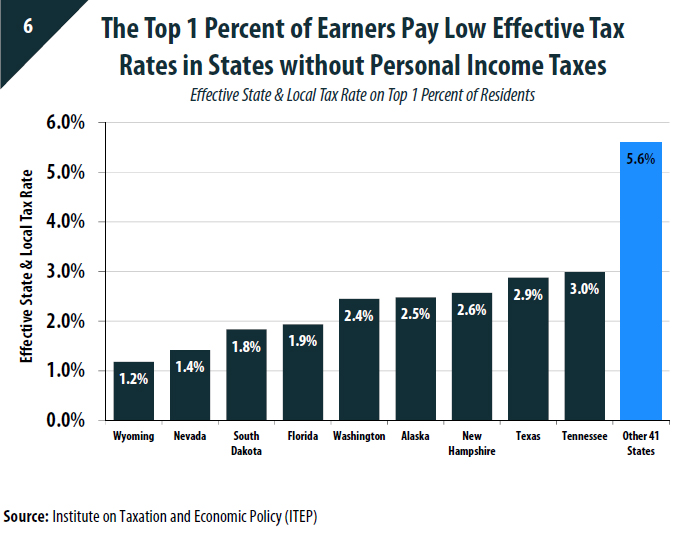

A Better Wyoming Everything You Know About Wyoming Taxes Is Wrong Itep

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole

Cost Of Living In Wyoming For 2022 Taxes Housing More Upgraded Home

The Most And Least Tax Friendly Us States

Wyoming State Economic Profile Rich States Poor States

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

State Income Taxes Highest Lowest Where They Aren T Collected

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Historical Wyoming Tax Policy Information Ballotpedia

How Illinois Income Tax Stacks Up Nationally For Earners Making 100k Center For Illinois Politics

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)